THE BASICS OF FOREX SPREADS: WHAT EVERY TRADER SHOULD KNOW

In this article, We will focus on forex spreads and all you need to know about online trading. Before we dive into the nitty gritty of Forex spreads, let us look at what spread is.

WHAT IS FOREX SPREAD?

We trade most forex currency pairs without any commission fees. Instead, Dominion Markets, like many other leveraged trading providers, incorporates a spread into the transaction cost. Spread is the difference between bid and ask price. A trader can buy at ask price and sell on bid price. The minor difference in price is charged by the broker.

This spread results in a slightly higher ask price than the bid price, replacing traditional commission charges.

The size of the spread depends on several factors, such as the specific currency pair you are trading, its level of volatility, the trade size, and the choice of trading provider.

TYPES OF FOREX SPREADS

Below, we will examine the two major types of forex spreads on Dominion Markets.

FIXED SPREADS IN FOREX

As the name suggests, fixed spreads stay constant regardless of market conditions. The spread remains constant whether the market is turbulent or not. Market Makers typically give these spreads.

Dealing Desk brokers purchase many positions from liquidity providers and then sell them to traders (clients). Because the brokers own these positions, they can control and display fixed spread prices to their clients.

Advantages of fixed spreads

Trading with fixed spreads doesn't necessitate significant capital, making them a viable choice for traders with limited funds. "Fixed" spreads make it easy to calculate transaction costs, and because spreads always remain constant, you will know exactly how much you will pay the broker for each trade.

Disadvantages of fixed spreads

Because pricing comes from one source (your broker), requotes are common when trading with fixed spreads.

There will be instances when the forex market is volatile, and prices change quickly. Because spreads are constant, the broker cannot extend the spread to reflect current market conditions.

If you attempt to enter a trade at a specified price, the broker will "block" the order and request that you accept a different price. The broker will requote a new price to you.

The requote notification will show on your trading platform, informing you that the price has changed and asking whether you are happy to accept the new price. It's almost always a lower price than the one you requested.

Another area for improvement is slippage. When prices move quickly, the broker cannot maintain a stable fixed spread, and the price you eventually wind up after placing a transaction will be significantly different from the original entry price.

VARIABLE SPREADS IN FOREX

As the name implies, variable spreads alter in real time, much like currency rates. If the bid and ask prices fluctuate, so does the gap between the two. As a result, the spread changes as well.

Non-dealing desk brokers provide this form of spread. Without the intervention of a trading desk, these brokers collect prices from different liquidity providers and directly send them on to traders. Non-dealing desk brokers do not influence spreads. The interplay of market supply and demand and its overall level of volatility determines everything.

When there is an economic event, the spreads widen as is typical in the market. The same is true when market volatility falls.

Advantages of variable spread

Variable spreads reduce the experience of requotes, where a requote is the difference between the price at which you pushed the buy/sell button and the price at which the broker received your order. You will not encounter slippage.

Variable spreads enable transparent pricing because you will receive quotes from several liquidity sources, resulting in lower prices owing to more competition.

Disadvantages of variable spread

Scalpers should avoid variable spreads. The widening spreads can soon eat away any scalper earnings.

Variable spreads are equally detrimental to news traders. Spreads can spread so much that what appears to be a lucrative trade can quickly become unprofitable.

WHAT DETERMINES THE SPREAD IN FOREX?

Let us now look at the factors that influence the spread in Forex.

MARKET VOLATILITY

Volatility can generate fluctuation, which might influence the Forex spread. For example, major economic data might cause a currency pair to strengthen or weaken, altering the spread. If the market is volatile, currency pairs may gap, or the currency pair may become less liquid, causing the spread to expand.

TIME OF DAY

The time of day at which you initiate a trade is crucial. For example, European trading opens in the early morning for US dealers and Asian trading opens late at night for US and European investors. If you book a euro trade during the Asian trading session, the currency spread will likely be wider (and more expensive) than if you book the trade during the European session.

In other words, if it is different from the currency's typical trading session, fewer traders will participate in that currency, resulting in a lack of liquidity. If the market is liquid, buying or selling the currency becomes easier since there are sufficient market participants. Otherwise, forex brokers expand their spreads to account for the risk of losing money if they cannot exit their positions.

EVENTS

Studying the FX economic calendar will help you prepare for bigger spreads. By staying updated about what events can lead currency pairings to become less liquid, you can make an educated guess about whether their volatility will rise and if you will see a wider spread. However, unexpected economic data or breaking news can be difficult to plan for.

CALCULATING THE FOREX MARKET SPREAD: A STEP-BY-STEP GUIDE

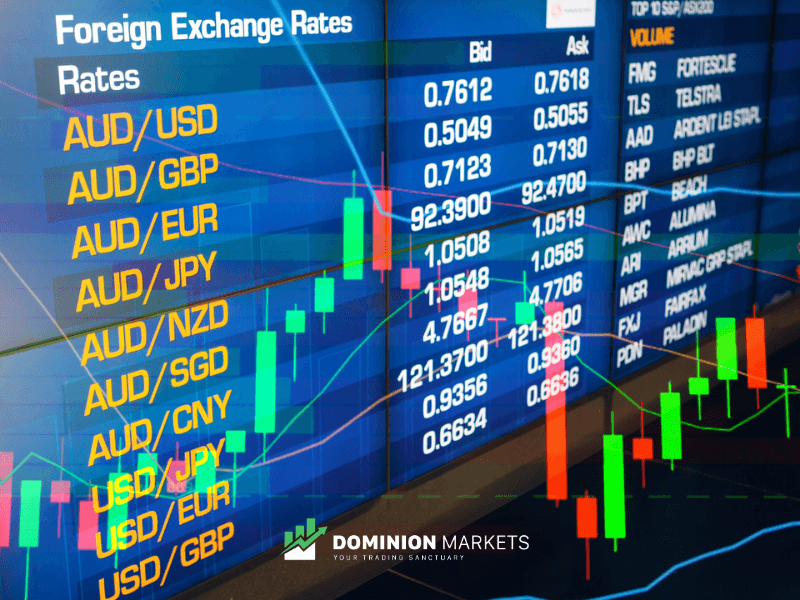

Now that we understand what affects spreads in Forex Markets, we can calculate their spread. Like the equity markets, Forex quotes are always issued with bid and ask prices.

The bid is the price Dominion Markets is willing to purchase the base currency (USD) in exchange for the counter currency (CAD). Conversely, the asking price represents the rate at which Dominion Markets exchanges the base currency for the counter currency, indicating their willingness to sell.

The bid-ask spread represents the price disparity when purchasing and selling a currency through a broker. For instance, imagine a US investor who wants to take a long position and purchase euros. The broker's trading platform quotes the bid-ask price at $1.1200/1.1250. The investor must pay the asking price of $1.1250 to initiate the buy transaction.

If this investor were to sell the euros back to the broker promptly, they would be given the bid price of $1.1200 per euro (assuming there was no change in the exchange rate). In simpler terms, the speculative trade resulted in a cost of just $0.0050 for the investor, primarily due to the bid-ask spread applied by the broker on the currency exchange rate.

Dominion Markets offers highly competitive spreads on its all accounts. If you compare the spreads, Dominion Markets stands out. Here’s a screenshot of live spreads from the ECN account.

Live spreads from MT5

The EURUSD spread is 0.2 pips while the rarely traded crosses like AUDNZD has a spread of 1.3 pips.

FOREX SPREAD INDICATOR

The spread indicator is a common tool among forex traders. We use it in a chart to graphically display the spread at a glance. The curve indicator illustrates the spread's direction about the bid and ask prices. Spreads on highly liquid currency pairs are typically lower.

UNDERSTANDING THE INDICATOR

Spreads are calculated measures that frequently require you to calculate the difference between the bids and ask prices manually. Traders attempting to capture minor variations in the spread must handle quotes with a large number following the decimal. As a result, the spread indicator oscillates within a fairly narrow band.

The EUR/USD and USD/JPY currency pairs are the most liquid and have the smallest spreads in forex, while currency pairs such as the USD/THB (Thai baht) and USD/RUB (Russian ruble) have the biggest spreads.

Because entering and exiting a deal costs less, traders tend to trade in currency pairings with modest spreads.

WHY IS SPREAD IMPORTANT?

Different dealers are cost-conscious to varying degrees. The degree to which you must be cost-conscious depends on the method you employ. The shorter your trading style and the more frequently you trade, the more aware you must be of the size of the spread. The spread size becomes less important if you are a long-term trader looking to make many pips over weeks or months.

However, whether you are a day trader or a scalper, the magnitude of the spread can mean the difference between making and losing money. The transaction charges will soon pile up if you are frequently in and out of the market. If you trade in this manner, you must ensure that you trade at periods when the spread is best.

Combining indicators is often a good idea, with one or more supplemental instruments used to confirm the conclusions of your main indicator. You can use a spread indicator as a final filtering modification to guarantee you're not trading at an inconvenient moment.

Remember that this may only be useful for some: if you employ a technique that trades infrequently, you will likely want to add another filter that excludes trades when the spread is greater than normal.

Discover the essentials of live Forex spreads, types, factors affecting them, and why they matter to traders. Explore fixed and variable spreads with the best forex trading company, Dominion Markets.