Introduction To Pip Value

Pips are at the core of trading. You will encounter this term throughout your trading journey on Dominion Markets. Let us first look at the definition of a pip.

WHAT IS A PIP?

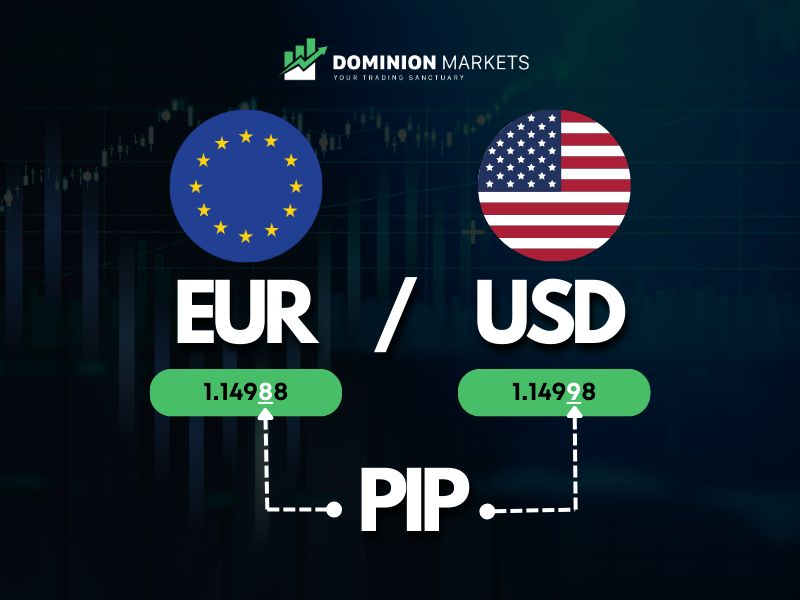

In a foreign exchange quote, a pip is the smallest unit measurement of the difference between the bid and ask spread. A pip is one-hundredth of one percent, or 0001. The forex quote has four decimal places, As a result. Fractional pips represent smaller price increments, sometimes known as "pipettes."

A pip is a fundamental notion in the foreign exchange (FX) market. Forex traders purchase and sell currencies valued against other currencies. Quotes for these currency pairs appear as bid and ask spreads with four decimal places.

We use pips to calculate the movement of the exchange rate. Because most currency pairs appear as four decimal places maximum, the lowest whole unit change for these pairs is one pip.

FACTORS AFFECTING PIP VALUE

A pip's value depends on the following:

- The lot size

- The execution price

- The pip move.

Suppose the currency pair you are trading is EUR/USD, and the lot size is the normal 100,000 units. Calculate the pip value by multiplying 100,000 by the EUR/USD's minimum pip value, or 0.0001.

HOW PIP VALUE DIFFERS ACROSS CURRENCY PAIRS

Because of the dynamic nature of currency exchange rates, the value of one pip always varied between currency pairs. When the US dollar is the quote currency, a phenomenon occurs. When this happens, the value of the pip is always equal to US$10 for a notional amount of 100,000 currency units.

The pip (percentage in point) value differs across currency pairs in the FX (forex) market due to variations in the exchange rates and the quote convention used for each pair. Here's how pip value differs across currency pairs:

Currency Pair Convention:

In many currency pairs, for example, EUR/USD, GBP/USD, or USD/JPY, pips are typically the fourth decimal place (0.0001).

In currency pairs with the Japanese Yen (JPY), like USD/JPY or EUR/JPY, pips are generally in the second decimal place (0.01). These pairs have pips on the second point because people trade the Yen in lower denominations.

Exchange Rate Levels:

Currencies that have a higher exchange rate have smaller pip values. An example of such a currency pair is the EUR/USD. If the exchange rate for EUR/USD goes from 1.1000 to 1.1001, that's a one-pip movement, representing a small change.

Conversely, currency pairs with lower exchange rates, for example, USD/JPY, have larger pip values. If USD/JPY moves from 120.00 to 120.01, that's a one-pip movement, but the change is more significant than the EUR/USD example.

Cross Currency Pairs:

Cross-currency pairs don't have the US Dollar (USD). These currencies have different pip value calculations from the rest. To calculate, you must convert the pip value into USD using the current exchange rate.

CALCULATING PIP VALUE

The currency pair determines a pip's value, the exchange rate, and the trade value. When you fund your forex account with US dollars and the second currency in the pair (or the quote currency), like the EUR/USD pair, the pip is fixed at.0001.

You derive the value of one pip in this scenario by multiplying the trade amount (or lot size) by 0.0001. As an example, for the EUR/USD pair, multiply a trading value of 10,000 euros by 0001. The pip value is one dollar. If you bought 10,000 euros at 1.0801 and sold at 1.0811, you would profit by ten pips, or $10.

When the USD is the first (or base) currency in a pair, such as the USD/CAD pair, the pip value additionally includes the exchange rate. You divide the pip size by the exchange rate and then multiply it by the trade value.

For example,.0001 divided by the USD/CAD conversion rate of 1.2829 and multiplied by a typical lot size of 100,000 yields a pip value of $7.79. If you bought 100,000 USD at 1.2829 and sold at 1.2830, you would make a profit of 1 pip, or $7.79. That is how to calculate pip value while you trade on Dominion Markets - the best forex trading company.

Therefore, pip value varies depending on the currencies traded. It means that for a 100,000 lot size account, one pip in the EUR/USD pair would differ from 1 pip in the USD/CAD pair.

For EUR/USD, one pip is 100,000 euros multiplied by 0.0001. Therefore, one pip would be equal to $10.

Meanwhile, for USD/CAD, one pip would be calculated as 0.0001 divided by the exchange rate of 1.2829 and multiplied by 100,000 USD. Therefore, 1pip would be equal to $7.79.

As such, making a 200 pip profit on the EUR/USD pair would differ from a 200 pip profit on USD/CAD. 200 pips on EUR/USD is $2000 in profit, while the same is $1,558 in profit for USD/CAD.

You can ease these calculations using pip calculators. Pip value calculators are easily accessible through your browser. There are numerous types, each designed to help simplify these calculations.

PIP VALUE FOR DIFFERENT ASSETS

As we have seen above, pip value varies across different currency pairs. The same applies across various asset classes.

Gold

Gold pips are in the second decimal place, like the yen. To calculate the pip value for gold, you need to know the standard lot size and the price of gold. A standard lot of gold is 100 ounces. To get the pip value of a standard lot of gold, take 0.01 divided by the price of gold and multiply it by 100 ounces.

If gold is trading at $1900, then the pip value will be $0.00052.

Indices

Most indices, like the US30, also have the pip in the second decimal place. For instance, if US30's price is 1.23 and moves to 1.24, that is a change of 1 pip. The one pip size for US30 is 0.01, which equals a pip value of $0.01 for one US30 unit. One hundred units of US30 would have a pip value of $1.

In indices like US30, the broker sets the contract size on the trading platform. When calculating pip value on US30 or any other indices where a standard lot equals 100,000 units, apply the same formula above.

Indices derive their pip value from the host country's currency. For example, GER30 trades in Europe, so its pip value is in EUR (Euro), while US500 is in the US, and its pip value is in US Dollars.

PIP VALUE AND LEVERAGE

A typical Forex account has its basic unit as lots and pip units. A lot is the lowest amount of security a trader can exchange, whereas a pip is the smallest amount a currency can change. For US-dollar-related currency pairs, one lot is $100,000, and a pip unit is $0.0001. It is the most often used pip unit, and traders use it for practically all currency pairs.

The effect of a one-pip adjustment on a dollar amount is a pip value. It is vital to remember that the pip value is unaffected by the amount of leverage you use. The pip value is affected by the leverage size you have. Most brokers provide 100:1 leverage, which means that for every $100,000 transaction, you must have $1,000 in your account.

Regarding pip value for the US dollar, 100 pips equals one cent, and 10,000 pips equals one dollar. The yen is an exception to this rule. The yen's value is so low that each pip is worth 1% of a yen rather than a tenth of a unit.

HOW TO MANAGE RISK USING PIP VALUEPip-based position sizing is one technique to use pips for risk management in forex trading on Dominion Markets. The position size determines the number of pips a trader is ready to risk on a trade.

Traders must consider their account size and risk tolerance when calculating position size based on pips at risk. The 2% rule is a regularly used risk management strategy that advocates risking no more than 2% of the account balance on any trade.

Assume a trader has a $10,000 account and is willing to take a 50-pip risk on a deal. If you applied the 2% rule, the trade's maximum risk would be $200 ($10,000 * 0.02). The trader would divide the maximum risk amount by the pip value to calculate the position size:

Position size = $200 / $0.80 (pip value) = 250 units

The trader would enter a position size of 250 units, risking 50 pips and $200 on the trade.

As you can see, the pip value of currency pairs can vary significantly. This is why traders need to understand the pip value of the currency pairs that they are trading before they place a trade.

PRACTICAL APPLICATION OF PIP VALUE

A combination of hyperinflation and devaluation can drive exchange rates to a point where they become extremely difficult to manage. It not only affects consumers who have to carry large amounts of cash but also disrupts trading and renders the concept of a pip meaningful.

An illustrative historical instance occurred during the Weimar Republic in Germany, where the exchange rate plummeted from 4.2 marks per dollar before World War I to an astonishing 4.2 trillion marks per dollar in November 1923. The pip value reduced drastically to a point where the currency could not be traded.

Join Dominion Markets today and start trading using pip value. Understanding pip value is important, and you should use it to your advantage on Dominion Markets.